Eb5 Investment Immigration - Truths

Table of ContentsAll About Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.The Facts About Eb5 Investment Immigration RevealedHow Eb5 Investment Immigration can Save You Time, Stress, and Money.Eb5 Investment Immigration - Truths

While we make every effort to supply precise and current material, it needs to not be thought about legal advice. Migration legislations and laws are subject to transform, and specific scenarios can vary widely. For customized guidance and legal guidance regarding your particular immigration scenario, we strongly advise seeking advice from a qualified immigration attorney who can supply you with tailored assistance and make certain compliance with current legislations and laws.

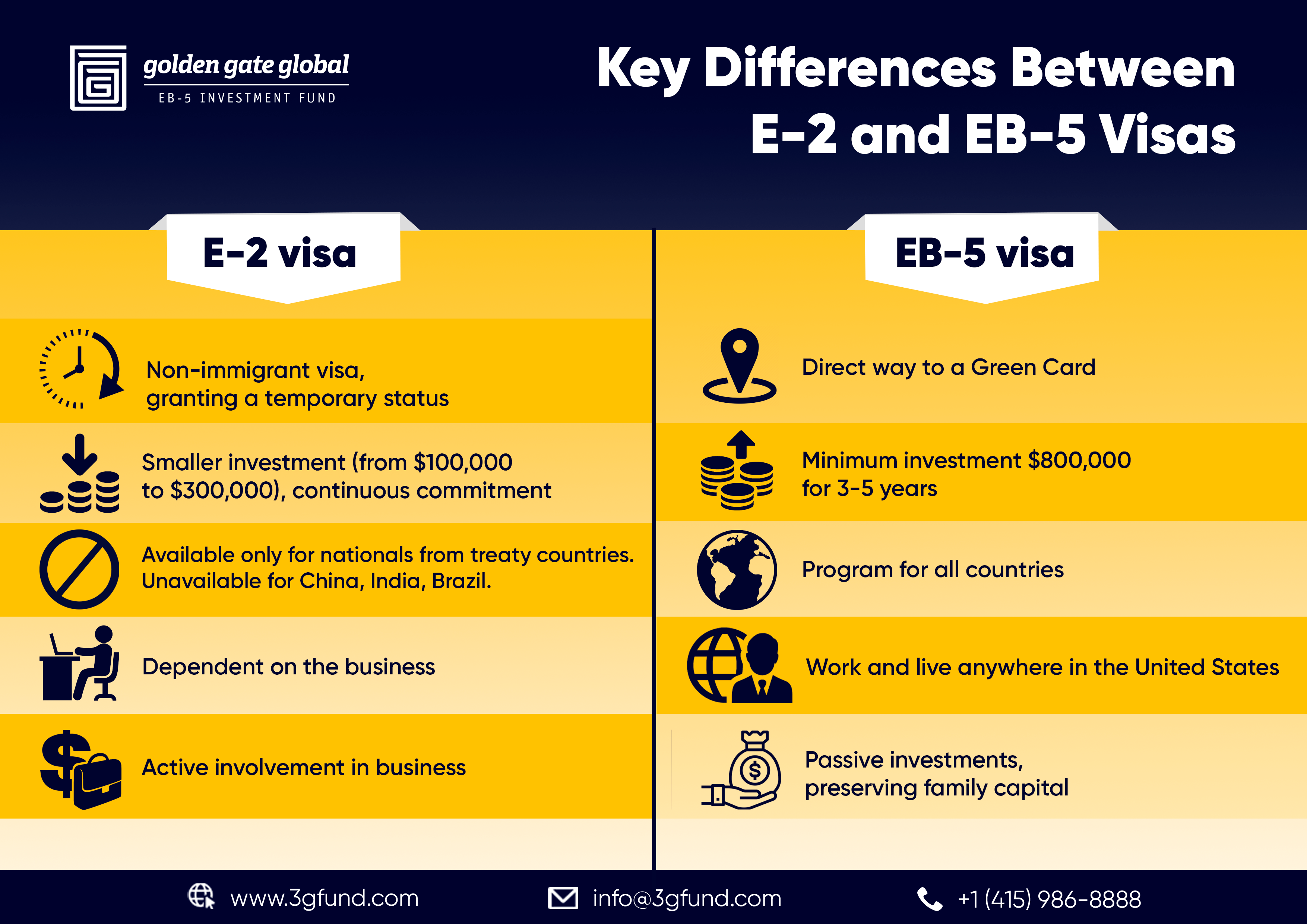

Citizenship, with financial investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Areas and Country Locations) and $1,050,000 elsewhere (non-TEA areas). Congress has actually authorized these amounts for the following 5 years starting March 15, 2022.

To get the EB-5 Visa, Financiers must create 10 permanent united state tasks within 2 years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Requirement ensures that financial investments contribute straight to the U.S. work market. This uses whether the tasks are created directly by the business venture or indirectly under sponsorship of an assigned EB-5 Regional Center like EB5 United

The Best Strategy To Use For Eb5 Investment Immigration

These work are identified via versions that use inputs such as growth expenses (e.g., construction and devices expenses) or yearly incomes created by recurring procedures. In comparison, under the standalone, or direct, EB-5 Program, just direct, permanent W-2 employee placements within the company might be counted. An essential threat of depending solely on straight workers is that team decreases due to market conditions could result in not enough full-time placements, potentially resulting in USCIS denial of the capitalist's application if the job development requirement is not fulfilled.

The economic version then forecasts the variety of direct jobs the brand-new business is most likely to produce based upon its expected profits. Indirect jobs calculated with financial versions describes work created in sectors that provide the items or services to the company directly included in the task. These jobs are produced as a result of the increased need for items, products, or solutions that sustain business's operations.

Things about Eb5 Investment Immigration

An employment-based fifth choice category (EB-5) financial investment visa gives a technique of becoming an irreversible united state homeowner for international nationals wanting to spend capital in the United States. In order to request this environment-friendly card, a foreign investor has to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and produce or protect at the very least 10 full-time work for United States employees (leaving out the capitalist and their immediate household).

This procedure has been a remarkable success. Today, 95% of all EB-5 funding is increased and invested by Regional Centers. Considering that the 2008 economic dilemma, access to funding has been constricted and municipal budgets proceed to face significant deficiencies. In lots of regions, EB-5 financial investments have actually loaded the funding space, offering a new, crucial source of capital for local economic development tasks that rejuvenate communities, produce and sustain work, framework, and services.

The Ultimate Guide To Eb5 Investment Immigration

workers. In addition, the Congressional Budget Office (CBO) scored the program as earnings neutral, with administrative expenses spent for by applicant costs. EB5 Investment Immigration. Greater than 25 countries, including Australia and the UK, usage comparable programs to attract foreign investments. The Get More Info American program is more rigorous than many others, requiring substantial danger for financiers in terms of both their economic investment and migration condition.

Families and people that look for to move to the United States on an irreversible basis can use for the EB-5 Immigrant Investor Program. The United States Citizenship and Migration Services (U.S.C.I.S.) set out different requirements to acquire irreversible residency with the EB-5 visa program.: The very first action is to find a certifying financial investment chance.

As soon as the opportunity has been news determined, the capitalist has to make the investment and submit an I-526 request to the united state Citizenship and Migration Services (USCIS). This application has to include evidence of the financial investment, such as financial institution declarations, purchase contracts, and organization strategies. The USCIS will evaluate the I-526 application and either accept it or demand extra evidence.

Unknown Facts About Eb5 Investment Immigration

The investor has to get conditional residency by sending an I-485 request. This request needs to be sent within six months of the I-526 approval and must consist of proof that the investment was made which it has actually produced a minimum of 10 full time tasks for U.S. employees. The USCIS will certainly review the I-485 application and either accept it or request added evidence.

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!